UK PAYE RTI Payroll

Stansoft is recognised by HM Revenue and Customs (HMRC) for real time submissions of UK PAYE.

Features

- RTI PAYE Payroll HMRC-recognised

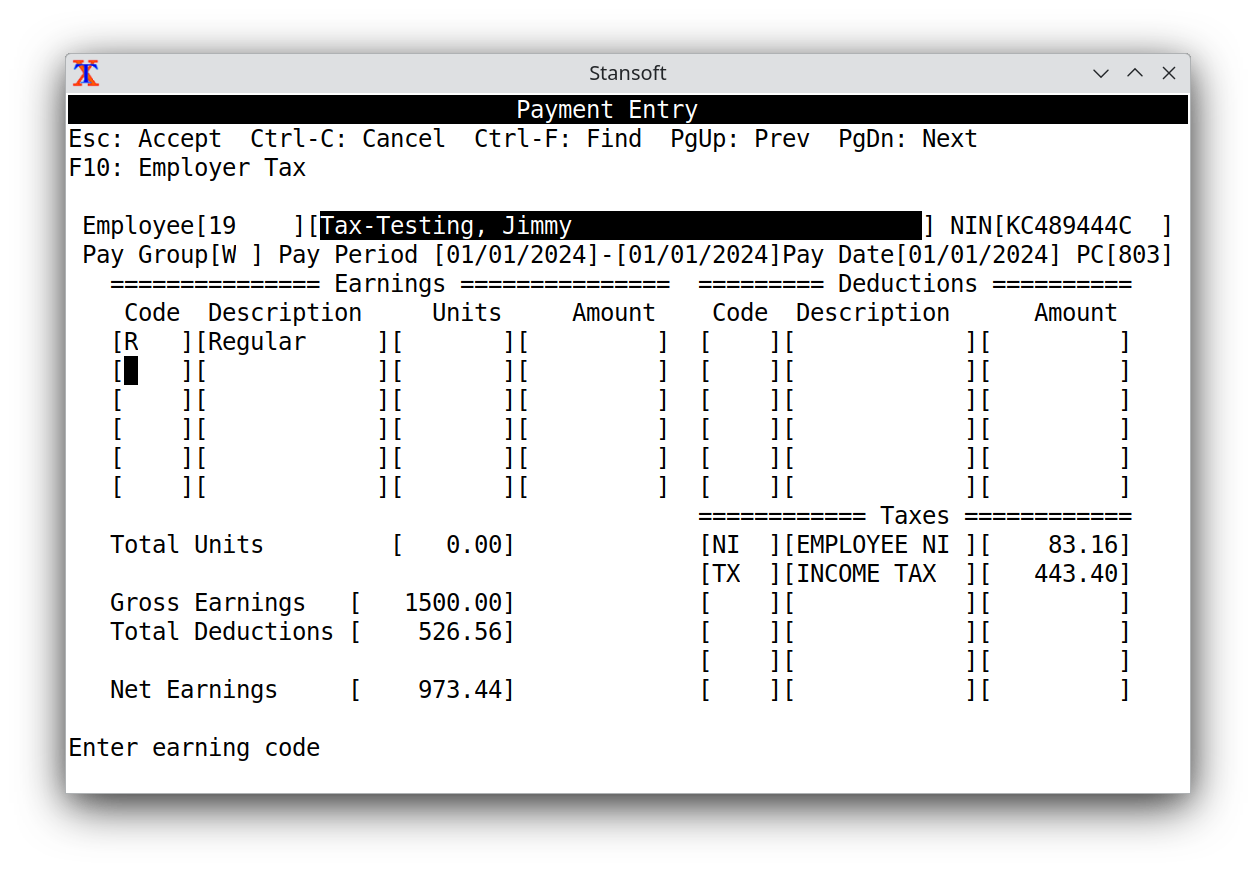

- Stansoft supports HM Revenue and Customs (HMRC) Real Time Information (RTI) Pay As You Earn (PAYE) payroll requirements. As an employer, you normally have to operate PAYE as part of your payroll. PAYE is HMRC’s system to collect Income Tax and National Insurance (NI) from employment.

- FPS

- A Full Payment Submission (FPS) is submitted to HMRC after each payroll to tell HMRC about payments and deductions to your employees.

- Payslips

- Payslips are generated to give to your employees, which show pay (gross and net wages), hours worked, and deductions like tax and National Insurance.

- Auto Enrolment

- Workplace pension can be deducted for automatic enrolment, and employee correspondence can be generated to notify employees of their enrolment into a pension scheme.

- Reporting

- Several reports are available: Payment/Earning Register, Tax Liability, Time Off, P45, and P60.

- Student Loan Deductions

- Plan type 1, 2, 4, and Post Graduate.

- PTO

- Paid Time Off (PTO) deductions for holiday, personal, and sick.

- Unlimited employees and companies

- There is no limit on the number of employees, companies, or users.

Getting Started

Download and install Stansoft. You must be registered with HMRC as an employer before payroll information can be submitted to HMRC using your login credentials for PAYE Online. Read the Quick Start Guide and view the PAYE demonstration video on Stansoft’s YouTube channel, both can be found at the links below.

Stansoft Quick Start Guide UK PAYE