UK MTD VAT

Stansoft is recognised by HM Revenue and Customs (HMRC) for digital VAT record keeping under the Making Tax Digital (MTD) requirements.

Features

- HMRC-recognised

- Purchase and sales information can be imported from a CSV file or entered directly into the Stansoft sales and inventory modules. Each purchase and sale can be imported/entered or only totals of both.

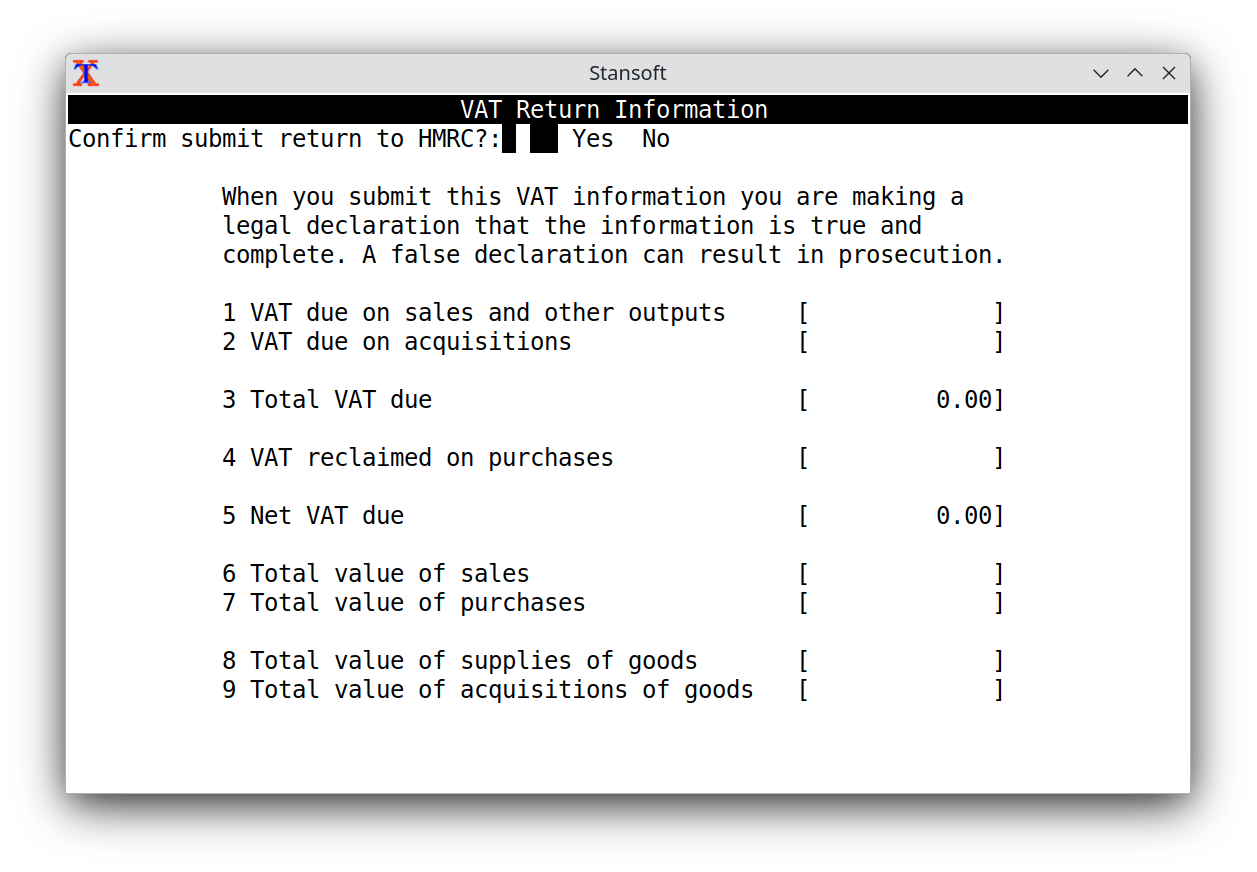

- Submit VAT returns to HMRC.

- Retrieve VAT filing obligations from HMRC.

- VAT submission history along with the HMRC response is stored in the Stansoft database on your server, which can be viewed or printed at anytime.

- VAT returns are listed indicating if they have been accepted or rejected by HMRC. Any rejected returns will have the reason for rejection stored.

Getting Started

Download and install Stansoft. Before returns can be submitted, you must sign up for MTD with HMRC. Read the Quick Start Guide and view the MTD VAT demonstration video on Stansoft’s YouTube channel, both can be found at the links below.

Stansoft Quick Start Guide MTD VAT